The requirement for insurance providers to clearly identify customers’ needs and demands has shaken up the pet insurance products on offer.

Since the enactment of the Insurance Distribution Directive 1 October 2018, pet insurance brands (like all others) must only offer customers products which deliver what they have asked for. And they have to ask the right questions to get to the right answer.

Pet insurance is confusing. The four types of products are complicated and their names do little to explain what they actually do. How many dog or cat lovers would appreciate “time limited” means ‘your pet’s treatment is covered for a year and after that you’re on your own… so try not to get a recurring health issue’. Whilst “maximum benefit” could mean ‘we’ll have stop paying for treatment if it reaches a certain cost, whether or not your pet is better’.

To help direct customers towards the right pet insurance policy, the price comparison websites and direct websites have added new questions.

Typically these are:

-

-

- Would you like your pet to be covered for accidents only or accidents & illnesses?

- This establishes whether to provide quotes for Accident Only policies. - Would you like short-term or long-term cover?

- This establishes whether to provide quotes for Time Limited policies. Time Limited being shorter term cover. - How much cover (£) would you like your pet to be covered for in the event of a claim?

- This generally sits at a minimum, e.g. £500 or more, and applies to the per condition limit on policies and establishes which products to quote for.

- Would you like your pet to be covered for accidents only or accidents & illnesses?

-

Not all sites ask all three questions. One, for example, doesn’t ask the second another doesn’t ask the third. Another offers the third as a filter on its results page.

With the addition of the above questions, brands almost don’t have to explain the difference between the four policy types (Accident Only, Time Limited, Maximum Benefit, Lifetime). They just have to deliver something that the customer wants.

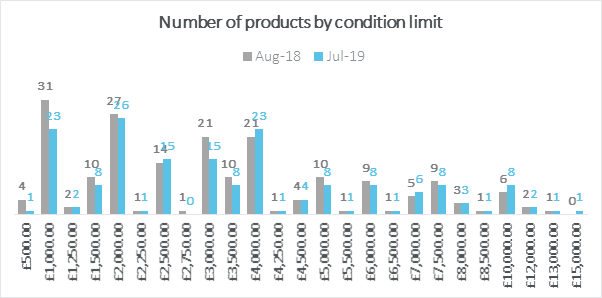

And it seems that reframing the question has caused a reduction in the number of products with low treatment limits.

Just one product with a condition limit of £500 remains in the market, whilst the number with a £1,000 condition limit has fallen by nearly a third, from 31 products last July to 23 currently.

Easier to compare

Websites and PCWs in particular have also improved their explanations of product types. The new policy type descriptions are generally longer and more detailed with the hope that they leave little room for confusion. However they still suffer from the challenges of simplifying the complex and their language seems compliance driven.

There’s been a major change to the way in which PCWs are displaying cover descriptions, specifically around vets fees. Previously it was common for descriptions of vets fees to vary wildly product-to-product & brand-to-brand. Sometimes it was bullet points, sometimes mini paragraphs. Now all the aggregators have shifted to bullet point style and created far more uniformity amongst the brands & products. They now list:

• Per condition limits

• Annual limits

• How those limits apply (e.g. reinstated at renewal or for life)

Confused has shown the largest change in this regard. Previously all vet fees were described with a single numerical value (e.g. 4000) with no context as to whether that was per condition or annual, or what would happen to those limits in the future of the policy.

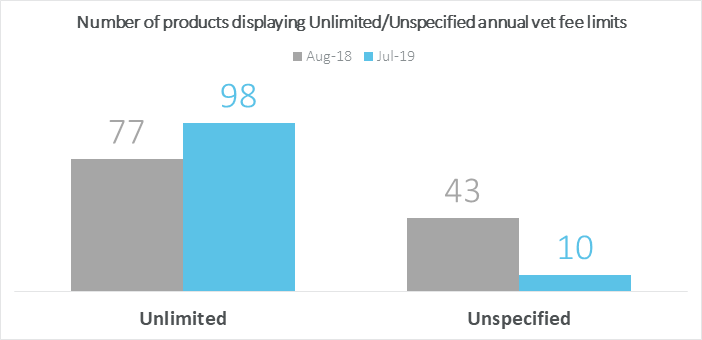

Due to the changes in how the vets fees are being displayed we’re seeing far fewer unspecified annual limits (annual limit being the maximum amount one could claim in a year regardless of number of conditions).

Asking better questions at the beginning of the process, improving the descriptions and making policies easier to compare is a good start and has helped market forces to remove some potentially unsuitable products from the landscape.

But there is more to do to help pet lovers navigate between so many types of products.

Optimise your competitive position in a fast-moving market

Understanding and optimising your product mix, particularly in your competitive context, can make all the difference when it comes to winning new business. To learn more about our pet insurance pricing insights, please click below.

Comment . . .

Submit a comment