Just 10 years ago the role of the call centre in insurance was ubiquitous, with the majority of new business being conducted through this channel. Over the next few years, as consumer confidence in e-commerce grew, the shift to buying online began; more recently that shift has moved more towards buying through price comparison websites.

These shifts in purchase channel now mean the role of the humble contact centre varies significantly between insurers depending on their channel acquisition strategy, their brand values and their target customer demographics. Holland says that the traditional call centre provides a valuable service to a range of different consumers depending on their particular buying habits.

“There are still people who will phone direct for a quote because there is a brand they know of who they want to speak to, but there are also people who have done their shopping around on the internet, narrowed it down to a few brands and then want to speak to someone,” she says. “It could be they want the reassurance of speaking to an actual person, or it could be they have some specifics of the policy they have concerns about that they want to check, or want to make sure they have chosen the right product for their needs.”

“Sometimes it is even because of fears around security of payment and completing a

whole transaction online.” she adds.

What drives consumers to pick up the phone?

Consumer-led:- Lack of confidence in online service

- Fears over security of online payment details

- Needing help understanding product details

- Lack of information online

- Need help with something specific to their policy

- Simple reassurance from an actual person

Insurer-led:

- Specific policy needs

- Further checks for payment options or due to risk profile

Some insurers also require potential customers to pick up a phone when going through an online quote as part of the sales journey, further muddying the waters for call centre operatives looking to determine what type of customer they are talking to.

“Certain insurers may drive some customers onto the phone because of a particular aspect of their policy they want to speak to them about or because they want to carry out enhanced fraud or security checks due to their risk profile,” Holland says. “This means it is not necessarily the channel of choice for this consumer, so the call centre agents need to be aware that some people will need more information than others and to be given confidence in the process, while some may just want a quick quote.

“It is all about confidence, listening, understanding and responding to what and how the customer is speaking.”

The contact centre must reflect your business strategy

Therefore, call centre agents need to be able to quickly determine the purpose behind the call, as well as the type of person calling, and then respond to that particular situation with a suitable approach.

The approach taken may also depend on the way the telephone call centre is viewed by the insurer. Some cover providers are now charging extra for completing a sale over the phone, or for making mid-term adjustments to the policy as they attempt to drive more customers online and away from the call centre.

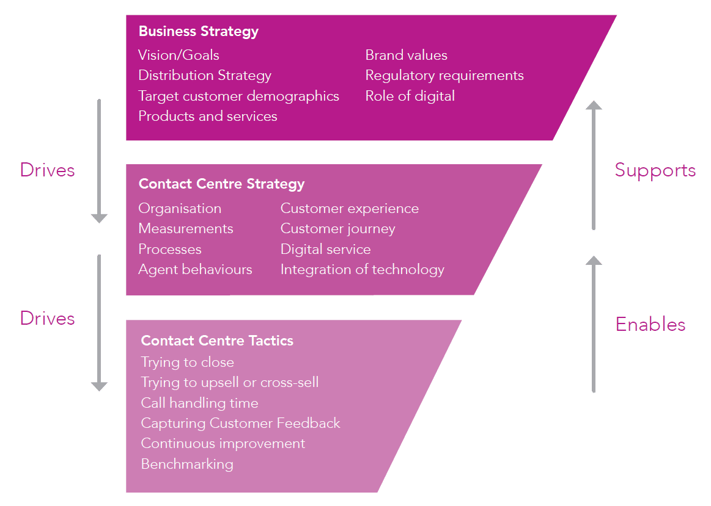

For some insurers, the telephone call centre has even become obsolete, with online only brands doing away with the channel for new business all-together, even if that limits consumer choice. Whatever overall business strategy your company has set, the contact centre practices must reflect and actively drive behaviours to deliver on that purpose and strategy and your desired market positioning.

Infographic: Telephone service for motor insurance customer journey

These insights come from our telephone mystery shopping programme, as well as a survey we carried out using our in-house panel and our Insurance Behaviour Tracker. If you've got questions on what your customers think of your call centre service or how to improve its efficiency and effectiveness, we can help you find the answers.

Submit a comment