One size doesn’t fit all when it comes to treating customers fairly. The Financial Conduct Authority (FCA) has made clear that it wants to see evidence from insurers and brokers about how they are identifying specific vulnerable customer groups and making any necessary adaptations to the way they design or distribute products.

But as we wrote about last month, different vulnerable customer groups have different needs and interact with financial services in different ways. Older drivers are the least likely to shop around. Customers from low income households are more likely to pay in instalments.

The FCA said in its consultation that it wants firms to understand the needs of vulnerable consumers in their target market and customer base, ensure their staff have the skills and capabilities to address the needs of those groups, and design their products and services to those needs into account.

It also expects firms to build a process to monitor outcomes experienced by vulnerable customers and use this to continuously improve and update how they treat them.

Benchmarking against peers and identifying vulnerable customers and understanding how you treat them is, therefore, gaining huge significance.

That’s why Consumer Intelligence has created some vulnerable customer profiles and can create may others due to our unique data sets.

The data can be used to answer key questions such as:

- Are you over / under indexed on any potential vulnerable customer profile?

- How do you serve vulnerable customers vs. non-vulnerable customers, e.g. do they trust you more or less, and would they recommend you to friends and family?

- How do you commercially approach vulnerable customers v non-vulnerable customers, e.g. quotability and price competitiveness?

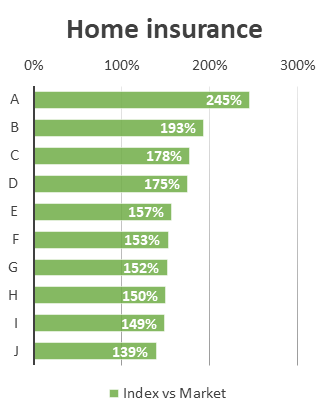

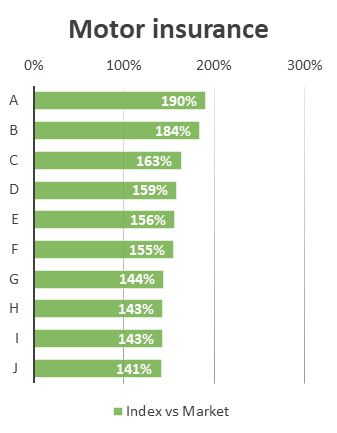

For example, we can see which brands over and under index for customers who are at risk of financial vulnerability.

Here our unique consumer database, the Insurance Behaviour Tracker, reveals that 42% of one home insurance brand’s customers are vulnerable customer profile X: C2DE with a household income of under £30k.

Relative to its market share, this brand is over-indexing for vulnerable customers by 245%.

If that’s by design and based on their poor navigation of financial services due to personal circumstances, the coming months could become quite uncomfortable. If it’s because they provide a valuable service to a group that finds it hard to access insurance, they could become a beacon of best practice.

Share of vulnerable customers - indexed vs the market

This is not a simple issue, and it’s hard to see how brands can demonstrate their grasp of the issue without a deep understanding of their customers.

Consumer Intelligence can help here.

Our Insurance Behaviour Tracker records how 40,000 home and motor customers bought insurance each year and what influenced their decision.

Problem solving begins with identifying if there’s a problem in the first place. As ever, the brands that will flourish are those with the best understanding of their customers.

How do you serve vulnerable customers?

Do you know how you serve vulnerable customers versus non-vulnerable customers? Do you know how you commercially approach vulnerable customers v. non-vulnerable customers?

We do, and can help you with your vulnerable customers strategy.

Submit a comment