.png?width=770&name=Van%20article%20(1).png) We recently wrote about how direct insurers are gaining market share in the car insurance market.

We recently wrote about how direct insurers are gaining market share in the car insurance market.

Powered by the technologies that facilitated the quiet takeover in motor, and the turmoil of Ogden rate changes, insurers are now turning their focus to van insurance.

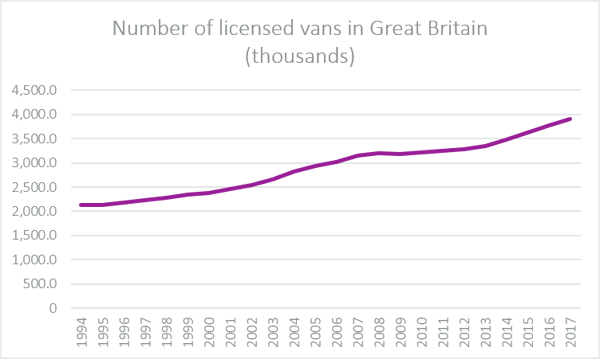

The size of the market itself is growing, with nearly 4 million light goods vehicles licensed in Great Britain at the end of the 2017, while the average premium of £1,190 is much higher than standard motor’s £740.

(Source: Department for Transport)

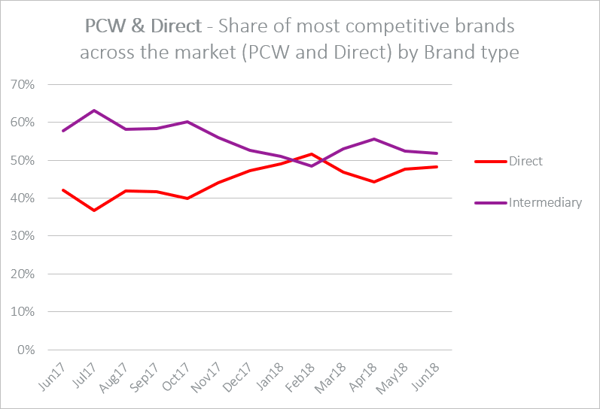

When those 4 million drivers look for an insurance policy, the brands appearing at the top of their search results are very different to a year ago. Brokers still dominate the channel, but not as comprehensively as they used to — the proportion of direct insurers offering a top price has risen from 42% to 52% in the last year.

(Source: Consumer Intelligence)

Admiral and Aviva have led the way here.

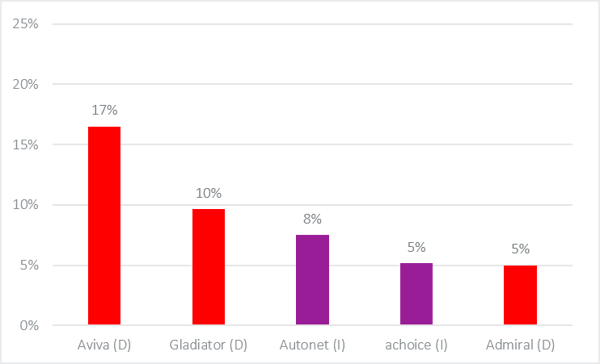

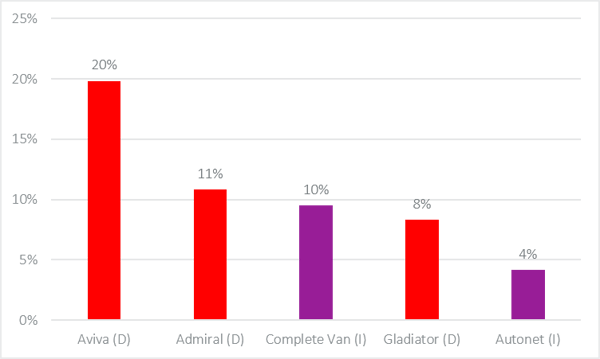

A snap shot view of June 2017 shows that a year ago, Admiral was in fifth place, offering 5% of the cheapest quotes across the PCW and Online Direct marketplace. This June it was second place with 11% of the cheapest quotes.

Combined with Gladiator, Admiral provided 19% of the cheapest quotes. Gladiator has itself shifted from an Admiral-owned open market panel broker to only offering policies which have been underwritten by Admiral. This dual-brand strategy helps Admiral Group on PCWs. Where it can win two of the top spots, it gets more of the pro-active marketing rights to contact and convert customers.

Aviva has strengthened competitiveness entirely on its own direct channel as it is not sold through PCWs. On its own website, it offered 20% of the cheapest quotes in the market this June, compared with 17% a year ago.

Van specialist Autonet, on the other hand, has been pushed down from third to fifth position and achoice has crashed out entirely from 5% of the cheapest quotes to none. That’s not to say all is lost for brokers, as the figure show, Complete Van has increased its competitiveness, moving from 4% of the cheapest quotes a year ago to 10% of the cheapest quotes last month.

June 2017: Proportion of cheapest quotes across PCW and Direct Channels by Brand (Top 5)

(Source: Consumer Intelligence)

June 2018: Proportion of cheapest quotes across PCW and Direct Channels by Brand (Top 5)

(Source: Consumer Intelligence)

As private car insurance gets more competitive, we expect more direct brands will look to replicate their success in other areas such as this. The challenge for specialist brokers to maintain their successful niches is on.

Insight that will enable you to optimise your pricing strategy

Download our Van Insurance Price Index to gain insight into market movements, benchmark the major van insurance brands and help you understand the data behind the results.

Submit a comment