Everybody knows the slogans by now. No evening soap or variety show is complete without a blessed one second of silence before the ear crunching compressed sound of opera singers or aggravated meerkats sends your actual cat flying out of the room. The Internet has become truly mainstream, and who dared to imagine that the stars of this brave new age would be the mascots for price comparison sites?

But there's a lot more to bringing in new car insurance customers and renewing the policies of existing ones than anthropomorphism - cashback offers, for one.

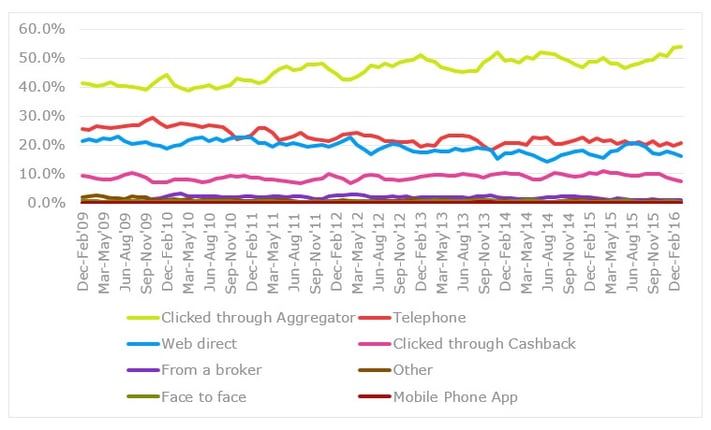

While cashback websites a remain popular, offering deals for food, fashion and other types of fun, data from Consumer Intelligence tells a different story when it comes to motor insurance: the number of people buying through cashback websites is slightly decreasing.

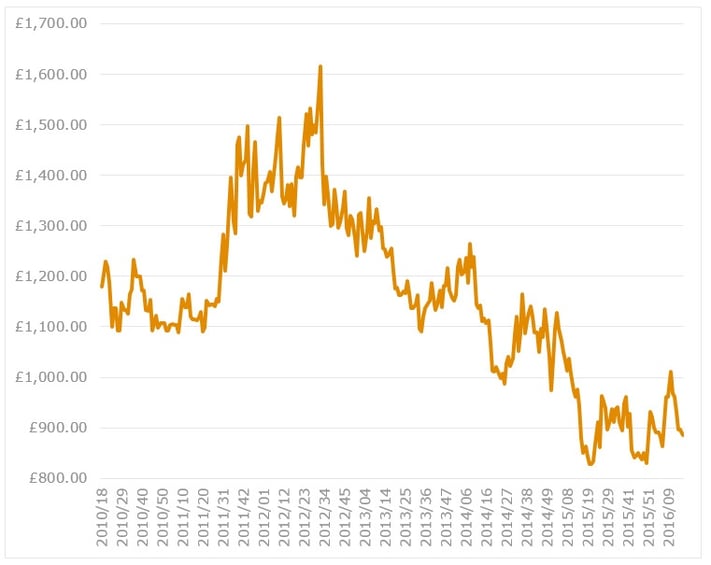

This is mirrored by a drop in the number of companies offering cashback - along with a dramatic drop in the quality of offers that are present. This can be measured by adding together the total amount of cash back deals available on a cash back site. In the graph below we have choosen QuidCo. This is data we have been collecting for several years. At one point new customers and those renewing had offers up to £1600 in 'free' money, but are now more likely to receive almost 45% less when they purchase insurance via this method – a relatively measly £900.

Figure 1 - Total amount of Motor Insurance Cash back available

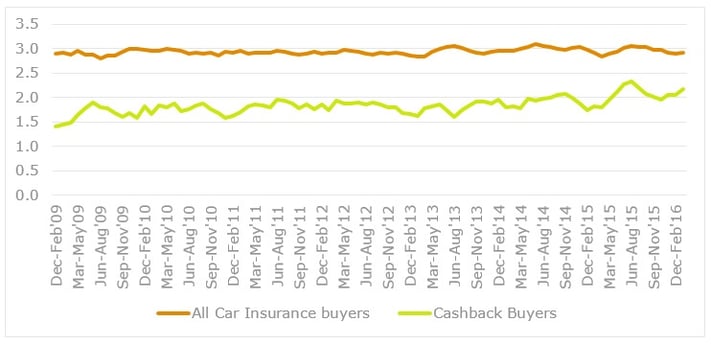

It's no trade secret that somebody who's willing to shop around for cashback deals is going to be vigilant and seek better deals elsewhere as often as possible, and this is evidenced by data showing that the average policy life for previous insurance before renewal with cashback users is 2 years, whereas market wide we see an average of 3 years. However, despite the drop in quality of cashback offers mentioned above, this number is trending upwards - gradually.

Figure 2 - Average Tenure of motor policy by method of purchase

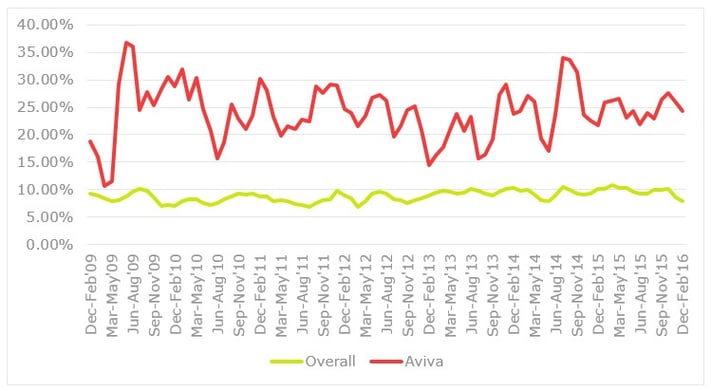

We can see that Aviva takes in 20% of its new business from offering cashback deals, compared with the market wide figure which rarely moves over 10%. Aviva also bucks the market trend when it comes to customers brought in from the telephone - since November - January 2016 until January - March 2016 this number has gone from making up just over 15% of sales to 26%, its highest figure within the last three years, whereas in the market taken as a whole, this figure has dropped (data available separately).

This may be because Aviva, along with Direct Line and Zurich, makes a song-and-dance about staying off the large comparison listings, which the big consumer-facing financial websites are quick to point out. This helps to put the busy action across a range of channels.

With the car insurance industry lately experiencing tough times with the recent rise in insurance premium tax (IPT), which saw an accompanying spike in customers shopping around for better deals , a question comes to mind: while cashback deals have dipped this low before, they have recovered. But is it wise to slash incentives when customers are more ready than ever to switch insurance providers?

Cashback is, after all, a solid, tangible and easily quantified reward for potential new customers. Aviva's success with cashback arguably shows how to inject some stability into what is currently an otherwise turbulent sector.

[1] The data used in this article was collected in 2016

Submit a comment