It’s been a difficult couple of weeks for personal lines brokers.

First, Ageas announced plans to close its Kwik Fit Insurance Services business, citing “changes in the way people buy insurance and the way the personal insurance market now operates” and the impact on declines in workload.

Now LV= has said it is planning to stop writing new business and inviting renewals for broker-distributed home insurance policies.

The news has highlighted the difficulty insurance brokers face when it comes to competing against direct insurers.

As Consumer Intelligence showed last week, direct writers have been achieving more top spots on price comparison websites and last month caught up with brokers to achieve a 50:50 split.

The reality is direct writers are dominating the top five positions on PWCs.

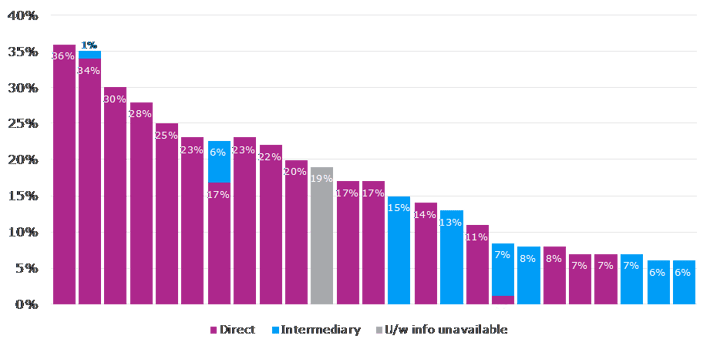

The below chart shows that 15 of the top-ranking 25 brands on one PCW are direct writers, three are hybrids, and that none of the seven traditional brokers using panels are in the top 10 of brands achieving a rank 1-5.

In a soft market (premiums have risen in the last year but are about 90% of their 2014 levels), cutting out brokers means one less mouth to feed and more direct and agile control over their pricing.

This is why brokers must differentiate themselves by offering customers something which insurers value beyond distribution which they can achieve themselves just as easily.

Leading PCW - % Rank 1-5s - Oct 2016 (Top 25)

The good news is that opportunities to delight customers exist in spades.

Most customers report having a mixed or good experience with insurance, so there is plenty of scope to be better.

They are also interested in innovation, such as through connected home monitoring, and many would be willing to try that service from an insurance provider.

But starting with the basics, brokers need to get their prices and brands right to grab the attention of consumers and make a sustainable profit.

Gain a deeper understanding of what drivers your customer

With our unique combination of market benchmarking and consumer insights, we have been providing exciting insights that help our clients make more informed business decisions for 13 years. We can help you benchmark your pricing, proposition and brand as well as gain a deeper understanding of what drivers your customer opinions and behaviours. If this sounds like something we could help you with, get in touch today.

Submit a comment