- Average premiums drop in the past six months but are likely to rise from next month

- Telematics send premiums for under-25s into reverse as older drivers pay the price

Car insurance premium rises have slowed in the past year and even went into reverse in the past six months, new analysis1 from insurance research experts Consumer Intelligence shows.

Its data shows the average most competitive premiums rose by 7.5% in the year to February to £740 but have dropped by 3.4% since they peaked in September last year. Prices have in fact fallen for five consecutive months — the first time since Consumer Intelligence records began.

Under-25s have seen average car insurance bills fall slightly over the past year by 0.6% as black box technology —so-called telematics — which rewards improved driving, helped insurers cut prices. Around 59% of the most competitive quotes for under-25s come from telematics providers.

But progress on Government plans to limit whiplash claims and confirmation of the new discount or Ogden rate, which sets pay-outs for major personal injury claims, of between 0% and 1% should help limit increases.

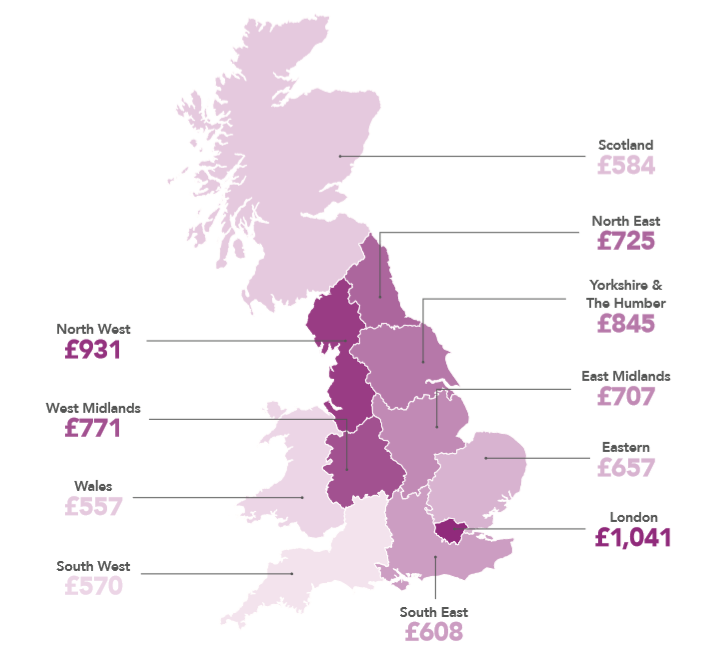

Over-50s drivers are suffering the biggest increases in premiums at 9.7% but still pay average prices of just £404 a year compared with £1612 for under-25s. Motorists in London pay the highest premiums at £1,041, which is nearly double the lowest at £557 in Wales.

John Blevins, Consumer Intelligence pricing expert said: “The drop in premiums since September is generally linked to insurers becoming more competitive in order to meet year-end goals.

“Average premiums are still 28.6% higher than in October 2013 when our records began but with progress on whiplash reforms and the Ogden rate, this year should be more positive for motorists.

“The big driver for car insurance, however, is claims experience and costs with the biggest impact being felt in major urban areas where crime rates are higher.”

The table below shows the average premiums and increases over the past year across the country. Drivers in Scotland are experiencing the highest price rises at 12.6% while motorists in the North West see the lowest increases at 2.8% although they pay the second highest annual premiums in the country.

|

REGION |

AVERAGE PREMIUM (FIVE CHEAPEST) |

PRICE RISE IN YEAR TO FEBRUARY |

|

London |

£1,041 |

6.9% |

|

North West |

£931 |

2.8% |

|

Yorkshire & The Humber |

£845 |

8.9% |

|

West Midlands |

£771 |

5.6% |

|

North East |

£725 |

10.8% |

|

East Midlands |

£707 |

9.5% |

|

Eastern |

£657 |

7.0% |

|

South East |

£608 |

6.2% |

|

Scotland |

£584 |

12.6% |

|

South West |

£570 |

7.2% |

|

Wales |

£557 |

10.4% |

|

GREAT BRITAIN |

£740 |

7.5% |

Premiums across the UK

Insight that will enable you to optimise your pricing strategy

Download our Car Insurance Price Index to gain insight into market movements, benchmark the major home insurance brands and help you understand the data behind the results.

Ends

Notes to Editors

¹The cheapest premiums were calculated by comparing the prices offered for 3,600 people by all the major Price Comparison Sites and key direct insurers. The top 5 prices for each person were compared to the previous month’s top 5, then these variations averaged to produce the index.

For further information, please contact:

Consumer Intelligence

Elinor Zuke

07863 350270

Kevan Reilly / Jonathan Flint

Citigate Dewe Rogerson

020 7638 9571

About Consumer Intelligence

Consumer Intelligence conducts consumer surveys and benchmarks price and service performance providing unique insights into competitor pricing and customer experiences, their attitudes, opinions and behaviours. For more information, visit the web site www.consumerintelligence.com

Submit a comment