It’s a scenario with which any analyst or performance marketer will be all too familiar.

Your client’s conversion rate has suddenly, almost inexplicably, dropped. You have a sense of what it could be; the bad news is the ‘it’ could be dozens of things — and likely several at the same time.

At Consumer Intelligence, we monitor a number of variables which gives us a unique, bird’s eye view of the Price Comparison Website (PCW) market. When something moves, we can see by how much, and why.

To that end, here's a look at six factors — or more specifically, six groups of factors — that could be dragging brands’ PCW conversions down. They split broadly into two buckets: those relating to price, and those that relate to other factors. For the avoidance of doubt, we appreciate the definition of conversion is fluid, and applies to many points in the marketing funnel. It could be looking at total risks quoted (regardless of rank) on one PCW, or across a portfolio, or drop-offs due to an imperfect user experience between referring PCW and brand website. Our focus here is on the price comparison part of the journey.

1. Who’s around you

This is the key factor. Everything is relative, and you exist only in relation to your competition. Our data shows a wide range of variance between brands, between products, and between PCWs. If either your brand, or other brands, make even a small change to their pricing strategy, it could have a big impact on your performance. So we always ask our clients this first: who are your competitors?

While we review this at client level (on a relative basis vs. individual or a group of competitors) we also monitor rates specifically — including tracking at the market level how many brands increase, how many hold, and how many decrease rate each month. This proved particularly useful in the volatile wake of the Ogden rate change last year.

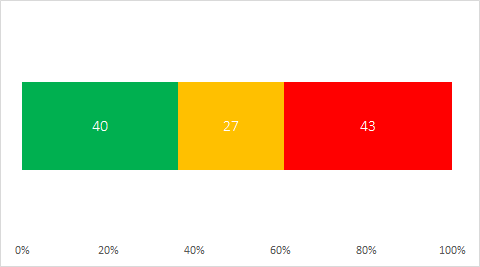

Motor Rate Change Barometer, Nov-Dec

The number of brands who increased, held and reduced rate on Compare The Market (CTM) in the two months ending December. Held is defined as movement of less than 0.5%.

If your product moves into a different price (and potentially audience) bracket, other factors such as product features will be subject to new testing, because the surrounding competitive products will no longer be the same.

Make no mistake: holding your pricing steady doesn’t mean your conversion will hold steady, too.

CI Impact Score:

2. How much is left on the table (LOTT)

An extension of the first point, but so critical it warrants its own slot.

It is estimated that around 95% of PCW sales come from the rank 1 position. This means two things: first, you’re going to have to pay for the privilege. Second, you need to make sure you’re not paying above the odds.

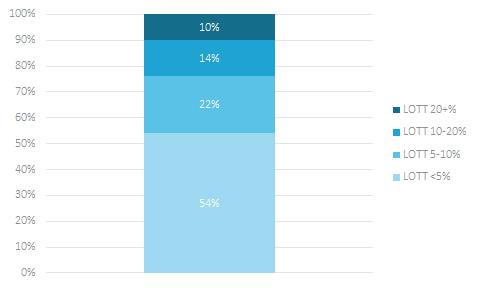

Our figures also show that the average price difference between rank 1 and rank 2 for motor is currently around £71 (excluding 17-19 year-olds). We also see that almost half of rank 1 prices are at least 5% cheaper than their rivals. Room to optimise, or conversion equilibrium?

LOTT – Motor Market

Based on a sample of 3239 risks on CTM, December 2017. Excludes 17-19 year-olds.

Perhaps you’ve been sitting pretty in your desired spot on Confused, £50 cheaper than your nearest rival. You’ve changed nothing, and yet suddenly your conversion drops off a cliff. A closer looks reveals that one of your competitors — or worse, a brand who has moved aggressively into your space — has slashed that gap in half to £25, pulling away your potential customers in the process.

Understanding both your absolute rank, and the difference between ranks is essential. It’s also where other factors like brand come into play. Consumers who know one brand will generally favour it over another they don’t, even when the known brand is more expensive. We also measure and comment on brand strength, and we observe that those with bigger brands do indeed convert at smaller LOTTs.

CI Impact Score:

3. Quotability and Pricing consistency

Both worthy of a section in their own right. If a brand is experiencing lower conversion on one PCW versus another, it can often be explained by inconsistent pricing or quotability. It’s also one of the first things we check: are you providing quotes for the same consumer across all PCWs? If you’re quoting 100% of the time on Moneysupermarket (MSM), but only 85% of the time on GoCompare, it directly affects your conversion, too.

The issue, however, can go beyond just whether a brand is quoting. For the same person, you may be quoting £500 on GoCompare (a Rank 1 price), but on MSM you may be charging the same consumer £520 — a rank 5 price from where you are far less likely to convert. If this consumer only visits MSM, you would not convert them. Blended conversion across the portfolio, effectively treating all PCWs as one, is a huge part of brands' acquisition strategies, and again emphasizes the point that conversion is a question of definition as well as a headline number.

Both pricing and quoting inconsistencies can be caused by a number of factors including mapping, filters or question sets. In terms of this ‘wasted footprint’, we often see brands with very high quotability failing to achieve competitive positioning for a significant proportion of their risks, which of course means no conversion.

CI Impact Score:

In the second part of this article, we will examine the impact of deals, discounts and offers, as well as brand strategy and external market forces including changing patterns of consumer behaviour.

Join the conversion conversation! What’s on your list, and why? Let us know in the comments.

Submit a comment