Unlike motor, the home insurance market has traditionally been dominated by intermediaries, but this sleepy backwater of the industry has seen radical change in the last 12 months.

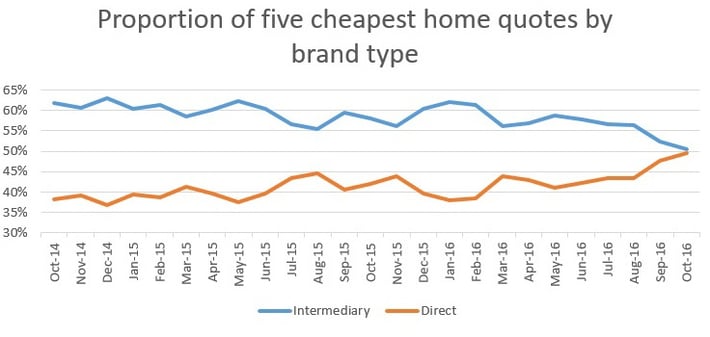

At the start of the year intermediaries provided 62% of the five cheapest quotes on buildings and contents insurance, compared with 38% from direct writers.

Come October, they were neck-and-neck.

So why are directs doing better?

One answer is with the rise of informed pricing control. A direct home writer can choose which data sources it uses to enrich the quote it provides and adjust rates in real time if its technology allows. In motor, some intermediaries and underwriters have plugged into insurer hosted pricing to allow the same in both channels. Home is likely to follow suit in time as insurers apply the same learnings and invest in new data sources to inform their pricing models.

With the right investment, insurers can respond quicker to changes in market conditions and adjust their rates in real time, rather than providing rating tables to software houses to plug into broker rating models.

Consumer Intelligence collects data on real quotes returned by insurance brands and can see a number of well known direct writers lowering prices or putting up rates at a slower pace than the market average.

At the other extreme, there are brokers with rates up by over 15% in a year.

Policy Expert, QuoteMeHappy, L&G and More Th>n have increased the number of times they provide one of the top five cheapest quotes significantly. Others have dropped out the race.

With average premiums of £123 lower than they were two years ago, insurers may want to keep more of the premiums for themselves. In any case they rely less on brokers for distribution thanks to aggregators.

Brokers may also be pricing more conservatively because it is becoming harder to supplement their income from other sources such as add on sales and payment by monthly instalments.

How to win at home

Consumer Intelligence can see which underlying insurers sit behind broker quotes. Are other brokers hitting better spots with the same panel of insurers? And if so, how are they doing it?

Get in touch to find out how we can answer those questions.

Submit a comment