Monitor, score and reward is the message almost every insurer is shoving in the face of consumers today. When I recently asked my wife what she thought about telematics insurance, she answered “I wouldn’t have it, I was done with being graded when I left university”.

Price isn’t everything, experience is

At Consumer Intelligence we have also been curious about what consumers think about telematics or "black box insurance" . So we put out a survey to our Viewsbank panel and we had over 1,500 responses from motorists aged 17 – 65+, and 91% of the respondents told us they did not have a telematics policy. So the big question is what’s stopping them? Is it about price? No, I don't think so.

The biggest target market is the most suspicious

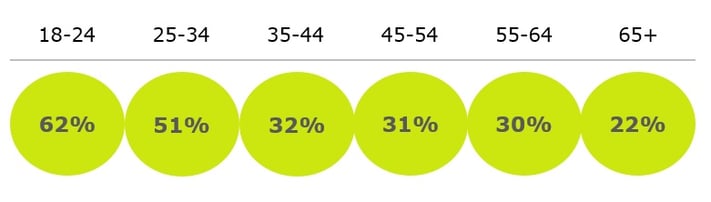

The results show that the group that black box insurance is most usually targeted at also happen to be the most suspicious. What is also interesting is that the older the driver, the less concerned they are about being watched. This is perhaps contrary to statistics showing older generations don’t want to give up their data . . . why? Because older drivers rate themselves as the safest drivers and statistically, they’re probably right! And the industry agrees with them.

"I don't like being watched"

(responses to the question "Why don't you have telematics?" split by age)

Source: Consumer Intelligence Viewsbank survey, n=1,453 March 2016

We’re not saying this is all bad. Some people don’t mind being monitored, and these policies encourages safer driving – especially in younger drivers. However, most insurers working in the area of connected car insurance are likely to be challenged every day on how to expand it outside of its current sweet spot. The tactic of ‘monitor, score, reward’ is putting up a barrier to the rest of the market.

Overt benefits are the key to unlocking consumer data

The issue of data ownership is often raised when considering location based insurance policies. The reality is, from a consumer perspective, they will knowingly or not, give up their personal data if there is an overt benefit to them. Tesco knows everything about a person through their shopping behaviour. Facebook have access to most people’s life story. Don’t even get me started on Google…

"Stop selling. Start helping."

Zig Ziglar

Harness the potential from new and existing technology

The term Trojan horse has been used within these circles before, we prefer to think of things as enabling technology and perhaps it’s worth the automotive industry looking at others for inspiration. Take Energy for example.

Hive has been in the market for some time now it's the black box equivelant in my home. Yes, you can save by being more efficient, but it has other massive benefits that make it worthwhile for consumers. It allows you to turn the lights on or off when you are away from home, it knows if there is a carbon monoxide leak and you can control the temperature meaning you can come back to a house that’s already warm.

This is as much about experience and making consumers lives easier and more enjoyable, as it is about cost savings. Hive is better placed to assess risk of fire, theft, damage and so on than many other insurance apps and when we asked consumers if they would be interested in having this kind of app in their house, a whopping 93% said yes.

What’s more, when we asked consumers who they trusted with their personal data, insurers were pretty far down the list. In fact, they rated banks as more trustworthy than insurers with their personal data! However, ask them who they would trust in the event of a home emergency and insurers rocketed up the list, even ahead of their energy provider.

Benefit and enhance consumer lives

So the point here is that insurance shouldn’t just be about money. It should be about making consumers lives easier and giving them peace of mind, that’s the big opportunity for insruance companies.

Stop trying to sell black box insurance. Stop just trying to offer a price saving. Start thinking about what you can offer to benefit and enhance consumers lives, because if you do, the benefits for insurers are potentially as great as they are to consumers.

Improve profit and tighten margins

Improve your sales and profit by understanding how your telematics price compares with other telematics insurance providers.

Find out how you can improve profit and where you might need to tighten margins to increase policy count.

About Matt Green

Matthew leads a team of insight professionals focused on clients’ needs and the delivery of value-adding services in line with Consumer Intelligence purpose of helping its client partners grow and protect their business.

A recent key note speaker at the Connected Car Insurance Europe 2016 event, the largest and most comprehensive forum in Europe dedicated to connected car insurance. Matthew presented an exclusive case study on Consumer Preferences for Connected Car Insurance.

Submit a comment