With budgeting month gathering pace, we have taken a step back and examined some of the long term industry trends and considered how they might impact your 2017 budget planning.

1. Switching is at an all-time high

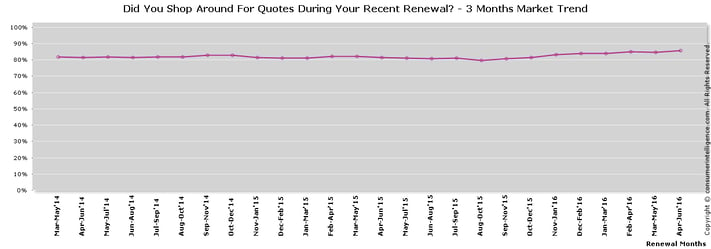

Shopping around for Motor Insurance has risen steadily for the last year as premiums have increased, and could reach 90% for the first time.

Click to increase image

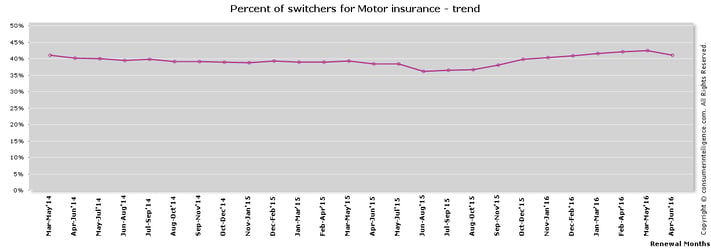

That’s translates into a 5-point increase in the number of motorists who decided to switch insurer in the last year. In real terms, we estimate an extra half a million drivers will change insurance providers this year.

If you want to make sure your customers are satisfied they’re better off staying where they are, you need to consider your retention strategy. What are you going to do differently to buck this trend? In our experience the brands with the most loyal customers focus on delighting the customer every single day across every single step of the customer journey.

Click to increase image

2. Path to purchase

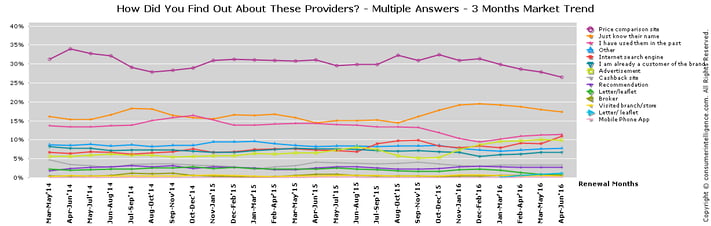

There’s no doubt that price comparison websites have given customers wider choice when it comes to buying their home and motor insurance. But rarely does just one media channel influence the consumers path to purchase. Our most recent survey showed that advertising and search engine results are also influencing consumer shopping habits. So whilst it is tempting to gear your marketing budget around the fixed CPA channels like PCWs, other media channels can also help move the customer through their buying journey - so for 2017 consider which other media have a role to play and how much budget should allocate to them.

Click to increase image

3. Price Comparison Websites are here to stay

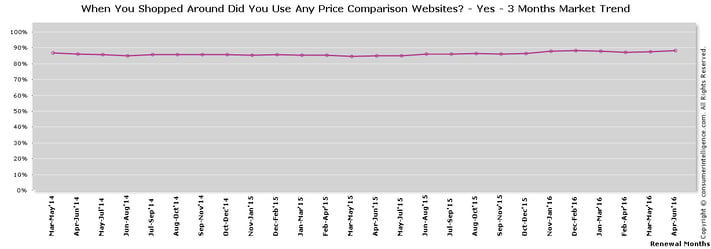

Price comparison websites have a huge role to play in the distribution strategy of most serious insurance brands with the exception of a few select brands who have made a deliberate decision to market their brands directly.

But our recent consumer insights show they may have reached peak saturation as whilst nearly 90% of people who shopped around used a price comparison website, this figure is unchanged from two years ago.

Click to increase image

Because not all of these converted into sales, it means getting your pricing and aggregator strategy right is fundamental. How do you maximize your presence on aggregators? Here are 5 questions you should ask before setting your 2017 aggregator sales target

- How often do I appear in the top 5 and top 10?

- Who else is around me and how far away are we in price terms?

- How strong is my brand and how strong are the brands round me?

- What offers can make my product stand out, and what are the best channels to promote this in?

Model how these changes will impact your business

Consumer Intelligence is working with insurers to model how these changes will impact their individual businesses.

Contact us if you would like to know what they mean for you and your business.

Submit a comment